In a world where liability keeps increasing, having an insurance is a big deal. There are lots of different types of life insurance out there, but one you might not know about is called decreasing term insurance. It’s a bit different from the others, but it can be really smart to have. So, what is it exactly? How does it help you? And why should you think about getting it? Let’s find out together as we explore the world of a type of term insurance!

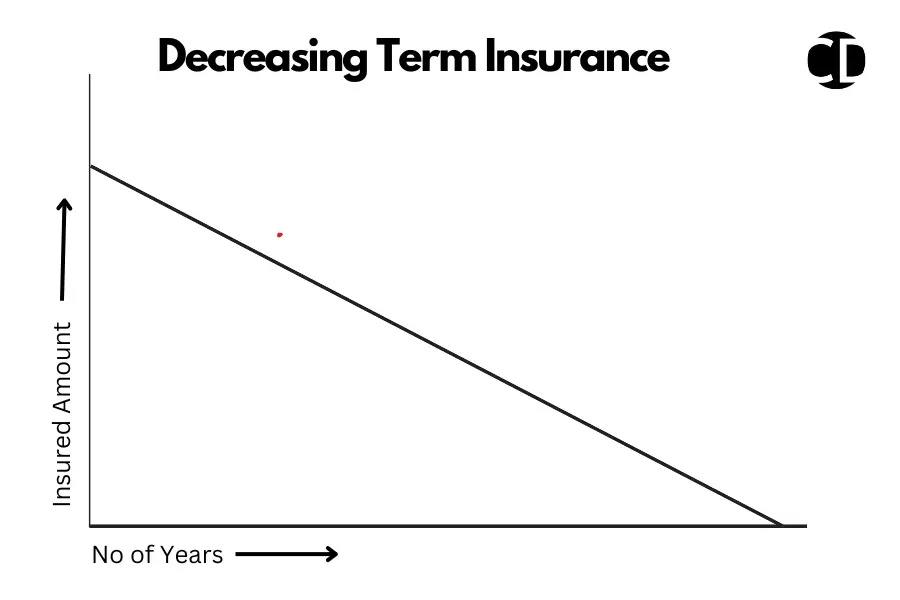

What is Decreasing Term Insurance?

Unlike traditional term life insurance, where the death benefit remains constant throughout the policy term, decreasing term insurance takes a different route. The coverage amount decreases over time at a predetermined rate. Picture it as a gentle slope—gradually descending as the years pass.

It’s often utilized to cover specific debts like mortgages or loans, ensuring financial obligations are met even in unforeseen circumstances.

When should we take Decreasing Term Insurance?

Decreasing term insurance is not like a regular term insurance and is typically taken out in cases where there are specific financial obligations that decrease over time. Here are some common scenarios where this term insurance may be suitable:

Mortgage Protection

A common choice among homeowners is to select this term insurance for their mortgage protection. This type of insurance is designed to align with the declining balance of the mortgage. As homeowners make regular payments, reducing the outstanding mortgage balance over time, the coverage offered by the policy similarly diminishes. This ensures that in the unfortunate event of the policyholder’s death, the insurance coverage remains sufficient to cover the remaining mortgage debt.

Repayment of Loan

Individuals who have taken out personal loans, car loans, or business loans may choose decreasing term insurance to ensure that these debts are repaid in full if they pass away before the loans are fully paid off. The decreasing coverage aligns with the decreasing loan balance, providing protection tailored to the outstanding debt.

To Cover Business Debt

Decreasing term insurance is a popular choice for small business owners to cover their business debts, like loans or lines of credit. This guarantees that if the owner dies unexpectedly, the insurance will help settle these financial obligations. It safeguards the business’s assets and ensures its smooth operation even after the owner’s passing.

Educational Expenses

Parents sometimes choose decreasing term insurance to cover their children’s education costs, like student loans. As the children finish school and the loans get smaller, the decreasing coverage makes sure any remaining balance is taken care of. This eases the financial pressure on the family.

As Key Person Insurance

In businesses, this type of term insurance can also be used as key person insurance. This means that if a key employee or executive passes away, the policy can provide funds to cover any outstanding debts related to the business or to help the business find and train a replacement.

Decreasing term insurance is a good choice when there are debts that get smaller over time, and people want to make sure these debts are paid if they die. It’s a personalized and affordable way to protect against the financial impact of unexpected death.

Benefits

Trimmed Coverage

Decreasing Term Insurance offers a bespoke approach to coverage. As your outstanding debts decrease over time, so does the coverage amount, ensuring that your loved ones are adequately protected without paying for unnecessary coverage.

Affordable

Decreasing Term Insurance is highly appreciated for its affordability, making it an attractive option for those looking to manage their expenses. Unlike traditional life insurance, where coverage stays the same, decreasing term insurance gradually reduces its coverage over time. This leads to lower premiums, as the coverage aligns with decreasing liabilities, such as mortgages or loans. This cost-effectiveness makes it appealing for individuals seeking comprehensive protection without overspending, providing peace of mind at a reasonable cost.

Peace of Mind

It brings a peace of mind by covering certain debts like mortgages or loans. It means your loved ones won’t struggle financially if you pass away suddenly, letting them focus on grieving without money worries.

It offers Flexibility

Despite what many people think, Decreasing Term Insurance isn’t just for mortgages. It can be adjusted to cover various decreasing debts like personal loans, business debts, or education costs. This flexibility lets policyholders customize their coverage to fit their financial situation.

FAQs

Yes, While Decreasing Term Insurance is commonly associated with mortgage protection, it can be used to cover any decreasing liabilities, making it a versatile solution for various financial needs.

In most cases, the coverage amount is fixed at the policy’s inception. However, some insurance providers may offer flexibility options, allowing policyholders to adjust their coverage to accommodate changing circumstances.

Decreasing Term Insurance is generally more affordable than traditional life insurance policies due to its decreasing coverage structure. This makes it an attractive option for individuals seeking comprehensive protection at a lower cost.

Hope you liked this article also checkout relevant content

Why it is important to have Term Insurance?

Also checkout Life for more informative content